Weekly Energy Industry Summary

Commodity Fundamentals

Week of March 2, 2026

By the Numbers:

- Prompt month (April) natural gas settled at $2.96/MMbtu, up $.10 on Monday, March 2.

- Prompt month (April) natural gas is trading up this morning at $3.14/MMbtu, up $.18 as of this writing.

- Prompt month crude oil (WTI) settled at $71.23/bbl., on Monday, March 2.

- Prompt month crude oil (WTI) is trading up sharply this morning at $77/bbl., up $5.77/bbl., as of this writing.

Natural Gas Fundamentals - Neutral

- The Global LNG market is having a bullish effect on the near-term natural gas pricing action.

- The weather in the coming ten days is decidedly bearish of natural gas with above normal temperature anomalies plus 15-20 degrees above normal in much of the eastern half of the U.S.

- Production is strong, averaging 109.7 Bcf per day, month-to-date versus 105.5 Bcf per day; same period last year.

- Residential/commercial demand, month-to-date, averaged 34.9 Bcf per day, down 3.3 Bcf per day from the same period last year.

- LNG exports, month-to-date, averaged 18.1 Bcf per day versus 15.6 Bcf per day, up 2.5 Bcf per day from the same period last year.

- The domestic U.S. market is well supplied, demand in the res/comm sector has been weak and is going to fall as spring-time temperatures move in over the coming week. The global LNG market is a plank of support.

- LNG (TTF - European benchmark) prompt month (April) settled at $15.30/MMbtu, up $4.21 on Monday, March 2.

- LNG (JKM - Asia benchmark) prompt month (April) settled at $13.36/MMbtu, up $2.64/MMbtu on Monday, March 2. JKM for May delivery settled at $16.49/MMbtu, up $5.68/MMbtu on Monday, March 2.

Crude Oil - Bullish

- Twenty percent of global oil and LNG supply flows through Strait of Hormuz the narrow channel connects the Persian Gulf to the greater Indian Ocean.

- The Straits of Hormuz are closed.

- As of this writing, prompt month WTI Crude is trading at $77/bbl, up $5.80. Yesterday, prompt month WTI settled at $71.23/bbl, up $4.21.

- On Monday, March 2, TTF (European benchmark LNG) for April delivery closed at $15.30/MMBtu, up $4.21.

- JKM (Asian benchmark LNG) for April settled at $13.36/MMBtu, up $2.64, while the May 2026 JKM contract closed at $16.49/MMBtu, up $5.68.

- Crude and LNG pricing are crawling a "wall of worry" as major military actions throughout the Gulf Region continues with Iranian drones threatening shipping and land-based energy assets in the region.

- Crude oil and LNG are decidedly bullish until further notice.

Economy - Neutral

- Equities markets are down sharply this morning 3/3, with the Dow Jones Industrial Average off 850 points, down 1.7%.

- All major indices are down with the S&P down 1.6%, the NASDAQ down 1.7% as uncertainty builds regarding U.S. military action against Iran.

- Higher oil and refined products pricing are a negative headwind for inflation.

- U.S. unemployment remains at 4.3%.

- February 2026 CPI data is scheduled for March 11, 2026.

- Wholesale inflation was hotter than expected in January.

- Mortgage rates fell below 6% for the first time in more than three years.

- All eyes on the Middle East and energy pricing.

Weather - Bearish

- Spring break is coming, but it may not feel like it on the East Coast. A strongly negative PNA is influencing the weather pattern, resulting in a cooler trough in the West and a warming ridge moving into the Plains and eventually farther east. This setup is expected to bring temperature anomalies of 15–20+ degrees above normal across the eastern half of the nation later this week through early next week.

- Cold air is expected to return to Canada during the 10-day period, and we begin to pick up differences in the weather models as we move into the 11–15-day period. Most model data shows that cold air will move down into the Mid-Continent and then shift eastward. The AI models show a stronger push of cold air that moves eastward a bit faster. The American operational model was an outlier, projecting much warmer conditions, so a cooler midday run is anticipated.

- 16–30-day Outlook: The American model shows a transient cold shot moving across the Plains and East in the middle of March. The European model shows a similar mid-month pattern, followed by a more extended period of chilly conditions in the East toward the end of March and continuing into the first couple of weeks of April.

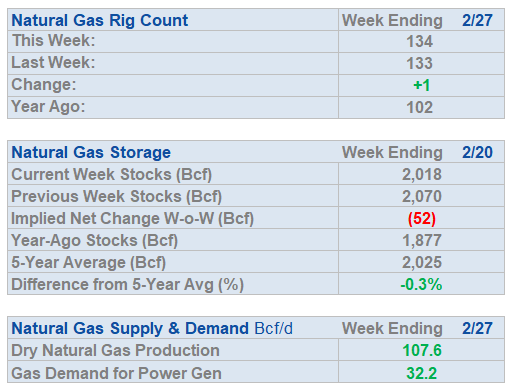

Weekly Natural Gas Report

- Inventories of natural gas in underground storage for the week ending February 20 are 2,018 Bcf; a withdrawal of 52 Bcf was reported for the week ending February 20.

- Gas inventories are 7 Bcf less than the five-year average and 141 Bcf more than the same time last year.

Weekly Power Report:

Mid-Atlantic Electric Summary

- The Mid-Atlantic Region’s forward power prices were relatively unchanged over the past week, across the board. The April’26 NYMEX natural gas futures settled slightly higher on Friday as market participants tried to balance bullish export activity and bargain buying against weakening weather demand and stout supply. The weather will transition from the cold start in the East to record low heating demand and may challenge some record high temperatures. This also means that cooling demand is showing up in the South, and there is a false sense that winter could be over in the North. Cold air is building in Canada over this, 10-day period and is expected to move into the Mid-continent and far northern tier during days 11–15. Forward power prices for the 2026-2030 terms over the past week saw little to no change over the whole term. The preliminary, final day-ahead settlement price average in West Hub for February is $88.68/MWh, which is -43% lower than January’s final settlement price.

- PJM Files an Expedited Interconnection Proposal (EIT) at FERC – On 2/27, PJM filed tariff changes to establish a new expedited interconnection process for up to ten interconnection requests per calendar year that, among other things, are for new or uprated generation of 250 MWs or greater that have complete site control, the ability to reach commercial operation within 36 months, and no existing application in PJM’s study process. EIT projects also need a commitment from the relevant state authority to support expedited siting. PJM argues that EIT will help address the urgent need for additional capacity to meet unprecedented load growth.

- New Jersey BPU Examines Alternative Utility Models - The New Jersey Board of Public Utilities (BPU) recently approved procuring a consultant, through a Request for Quotation (RFQ) process, to examine alternative utility business models as a mechanism to drive down electricity costs for New Jersey customers. The consultant will evaluate a range of potential regulatory reforms, including performance-based ratemaking as well as multi-year rate plans, reductions to utility returns on equity, least-cost resource testing, and securitization tools. The goal is to identify which combination of changes offers the greatest long-term savings for ratepayers while providing certainty for the industry and encouraging important investments to ensure reliability of the system. The RFQ is part of a broader effort by the Sherrill administration to tackle rising electric costs on multiple fronts and is being executed as part of Governor Sherrill’s Executive Order calling on the BPU to explore alternatives to the current utility business model. The resulting study will focus on the longer-term question of whether the underlying business model itself needs to be changed.

Great Lakes Electric Summary

- The Great Lakes Region’s forward power prices were slightly higher over the past week, across the board. April’26 NYMEX natural gas futures settled slightly higher on Friday as market participants tried to balance bullish export activity and bargain buying against weakening weather demand and stout supply. The weather will transition from the cold start in the East to record low heating demand and may challenge some record high temperatures. This also means that cooling demand is showing up in the South, and there is a false sense that winter could be over in the North. Cold air is building in Canada over this, 10-day period and is expected to move into the Mid-continent and far northern tier during days 11–15. Forward power prices for the 2026-2030 terms over the past week saw a 1% increase in all the annual terms except for 2027 which was unchanged. The preliminary, day-ahead settlement price average in COMED for February is $38.05/MWh, which is -55% lower than January’s final settlement price, while in AdHub that average price was $62.99/MWh or is -40% lower than the previous month. In Michigan, that preliminary final settlement price average for February is $53.21/MWh or is -46% lower than January, while in Ameren the average price is $43.27/MWh or is -53% lower than January’s average.

- PJM Files an Expedited Interconnection Proposal (EIT) at FERC – On 2/27, PJM filed tariff changes to establish a new expedited interconnection process for up to ten interconnection requests per calendar year that, among other things, are for new or uprated generation of 250 MWs or greater that have complete site control, the ability to reach commercial operation within 36 months, and no existing application in PJM’s study process. EIT projects also need a commitment from the relevant state authority to support expedited siting. PJM argues that EIT will help address the urgent need for additional capacity to meet unprecedented load growth.

- Backstop Procurement Workshops Continue with Education and Additional Stakeholder Presentations - On 2/24 and 2/25, PJM continued stakeholder workshops focused on initial design principles and mechanisms for conducting a reliability backstop along with education. PJM Board members, PJM staff, and stakeholders, including representatives from state PUCs and policy makers, participated in the workshops.

Northeast Energy Summary

- On 2/20, 17 Upstate New York Assembly Democrats urged Governor Hochul to act quickly on rising utility costs impacting homes and businesses this winter. Their letter recommends suspending state utility taxes, returning unused clean-energy surcharges, and using additional Regional Greenhouse Gas Initiative funds to lower bills. The lawmakers also propose long-term solutions like refunding excess utility earnings to consumers and establishing a state energy affordability office.

- On Tuesday, February 17, New Hampshire’s Senate Committee on Energy and Natural Resources (ENR) passed an amended version of a bill (SB 591) that would allow utility companies to own or build generation facilities. As amended, the bill would enable utilities to own generation facilities with a cumulative capacity of up to 10% of the utility’s peak load, which is roughly 250 MW total across the entire state. This limitation would not apply to storage facilities. Current law caps such investments at 6% and limits non-renewable investments to 3% of peak load. The amended version of the bill removes any restriction on the generation’s fuel or technology type. The bill will next be taken up by the entire Senate.

- On January 30, the Connecticut Department of Energy and Environmental Protection (DEEP) finalized its request for proposals (RFP) for new and existing zero carbon electricity resources. The procurement is intended to advance Connecticut’s statutory climate commitments, including economywide greenhouse gas reduction targets and the mandate for a fully zero carbon electric sector by 2040, while ensuring that the transition to clean energy remains affordable and reliable for ratepayers. DEEP’s objective is not simply to add clean megawatt hours, but to secure resources that provide demonstrable economic value, reliability benefits, and long-term price stability for Connecticut customers. Eligible resources under the RFP include Class I resources, nuclear generating facilities, hydropower, and energy storage paired and co-located with eligible generation. In addition, DEEP is using this procurement as a vehicle to consider certain transmission projects, particularly those associated with qualified energy resources bidding into a contemporaneous Maine Public Utilities Commission solicitation. DEEP has signaled its intent to work with other New England states on this solicitation. The RFP describes that Massachusetts, Maine, Rhode Island, and Vermont have expressed interest in reviewing and potentially selecting projects from this RFP. This will be important as Connecticut law currently requires two other New England states to join in any procurement from nuclear resources if one were selected for this RFP. Proposals tied to the Maine RFP are due 2/27, while all other bids are due 3/17. DEEP anticipates announcing selected projects in Q2 2026, followed by contract negotiations later in the year and regulatory review in Q3/Q4 2026.

ERCOT Energy Summary

CAISO, Desert Southwest and Pacific Northwest Energy Summary

- The Western U.S. continues to grapple with unseasonably warm trends as meteorological spring began Sunday. One outlier, Western Canada is bracing for a return to Arctic conditions – Calgary is potentially facing subzero temperatures by mid-month – California and the Desert Southwest however remain firmly entrenched in a warmer-than-normal pattern. The LA Basin and Phoenix recently saw daytime highs in the low 90s, and while a brief moderation is expected toward the end of the work week, the long-term outlook for the Golden State suggests it is time to pack the winter clothes away. This setup is creating the trifecta for renewable energy generation as warmer temperatures are whittling away at what little snowpack there is, clear skies are flooding solar panels across the Southland and a shift toward stormier weather in the Pacific Northwest is likely to bolster wind generation.

- In the natural gas market, California prices continue to live through a pronounced downward trajectory as warming temps dissolve heating demand. Both PG&E and SoCalGas systems are becoming increasingly long, leading to High operational flow orders (OFOs) calls on PG&E’s network as supply far outstrips demand. Crucially, regional storage levels remain well ahead of last year, and with the March withdrawal window rapidly closing (was it even open?), the question is when the space will be created for the spring and summer injections that loom in the not distant future. We expect the gas-fired generators need for molecules during Q2 will be sparse and will allow storage operators to begin their initial refill operations. The trifecta for power generation mentioned above further stifles the gas market; plus, as the battery fleet manages the evening ramps, natural gas is quickly losing its foothold in the generation mix and prices will be under pressure.

- The CAISO grid is entering a period of significant oversupply, characterized by waning demand and robust renewable performance. Day-ahead auction results over the past week in SP15 have seen four of the days clear in the single digits for peak hours; the high print was $15.28 MWh. The low print at $4.89 MWh for flow yesterday (Monday) is the low print so far this year. As daylight hours lengthen and the modest Sierra snowpack begins its seasonal melt, hydro generation will become more prevalent on a grid that is already saturated. South-to-North congestion is already rampant in prices and curtailment volumes will quickly ramp as CAISO dispatchers struggle to maintain balance.

- While the fundamentals of the West are in the buyer’s favor today, do not look past the turmoil unfolding in the Middle East. The conflict in Iran is sparking the biggest disruption to oil and natural gas markets since Russia’s invasion of Ukraine in February 2022. Qatar shut the world’s largest LNG export facility over the weekend, Saudi Arabia has suspended operations at its biggest oil refinery and tanker traffic through the crucial Strait of Hormuz has all but halted. As development of U.S. LNG export capability has ramped over the last decade, our prices – even those in California – will be increasingly sensitive to international events. Heads up.

Stay up-to-date on the latest energy news and information:

Coming soon from Constellation Customer Insights: Help us provide you with greater service by completing our online study later this month. For a limited time, eligible customers can choose to accept an incentive for taking the time to provide feedback.

- Energy Market Intel Webinar - Register for our next market update webinar on Wednesday, March 25 at 2 p.m. ET when the CMG team will provide insights on market factors currently affecting energy prices, such as weather, gas storage and production, and domestic and global economic conditions.

- Fortunato & Friends Webcast - Stay tuned for information regarding our next Fortunato & Friends webinar featuring Constellation's Chief Economist and a special guest

- Energy Terms to Know - Learn important power, gas and weather terms.

- Sustainability Assessment - We invite you to complete a brief assessment that helps us learn where your company is in building and/or implementing a sustainability plan. Through these insights, Constellation can customize solutions to meet your needs.

- Subscription Center - Sign up to receive updates on the latest market trends.

Questions? Please reach out to our Commodities Management Group at CMG@constellation.com.